NC Startup Accelerator provides $50K average investments and focuses on discovering Customers + Validation.

The first deadline is March 31st, when applications are due for the Winston Salem based New Ventures Challenge and Accelerator. Eight startup business teams will have an opportunity to receive an average $50,000 of seed funding. 2016 was the inaugural year for the program – first of a kind in the Triad.

All startup companies have two objectives:

a) discover a group of early adopters (customers) in order to…

b) validate the need for further investment funding.

Achieving those two objectives is a large focus of the accelerator program. The 12 weeks of immersive and experiential work in business modeling, prototyping and growth hacking include a follow on three month residency at Flywheel.

2017 will be my second year as Accelerator Director and my leadership partner is Flywheel Coworking founder Peter Marsh.

Peter told me: “The 2016 Challenge and Accelerator were so successful that almost all of the investors are migrating to this year’s fund, there is interest all over the Triad”.

Last year we had over 200 hundred applications but only five available spots. Because of the programs successes last year, the 2017 investment fund is larger and will allow for up to eight startup teams to participate.

NC Startup Accelerator provides $50K Average Investments

The expectation of the investors is that each startup receives an average investment of $50,000 upon completing the accelerator. New Venture’s role as an inception stage fund means it typically provides the first outside capital for a startup. New Ventures was the first acceleration program in the Triad to offer pre-seed money to startups. This was the one puzzle piece we needed to really fuel inception stage momentum in the Triad.

New Ventures elevated the entrepreneurial ecosystem in the Triad to the same playing field as Charlotte and Raleigh/Durham. But the big win at the end of the day is for these companies to receive more investment capital, as they create value for the company, investors and community.

Peter maintains that the majority of the last years cohort companies are successfully attracting follow-on financing, a key success metric for the accelerator.

I will take that as validation that we are doing the right things.

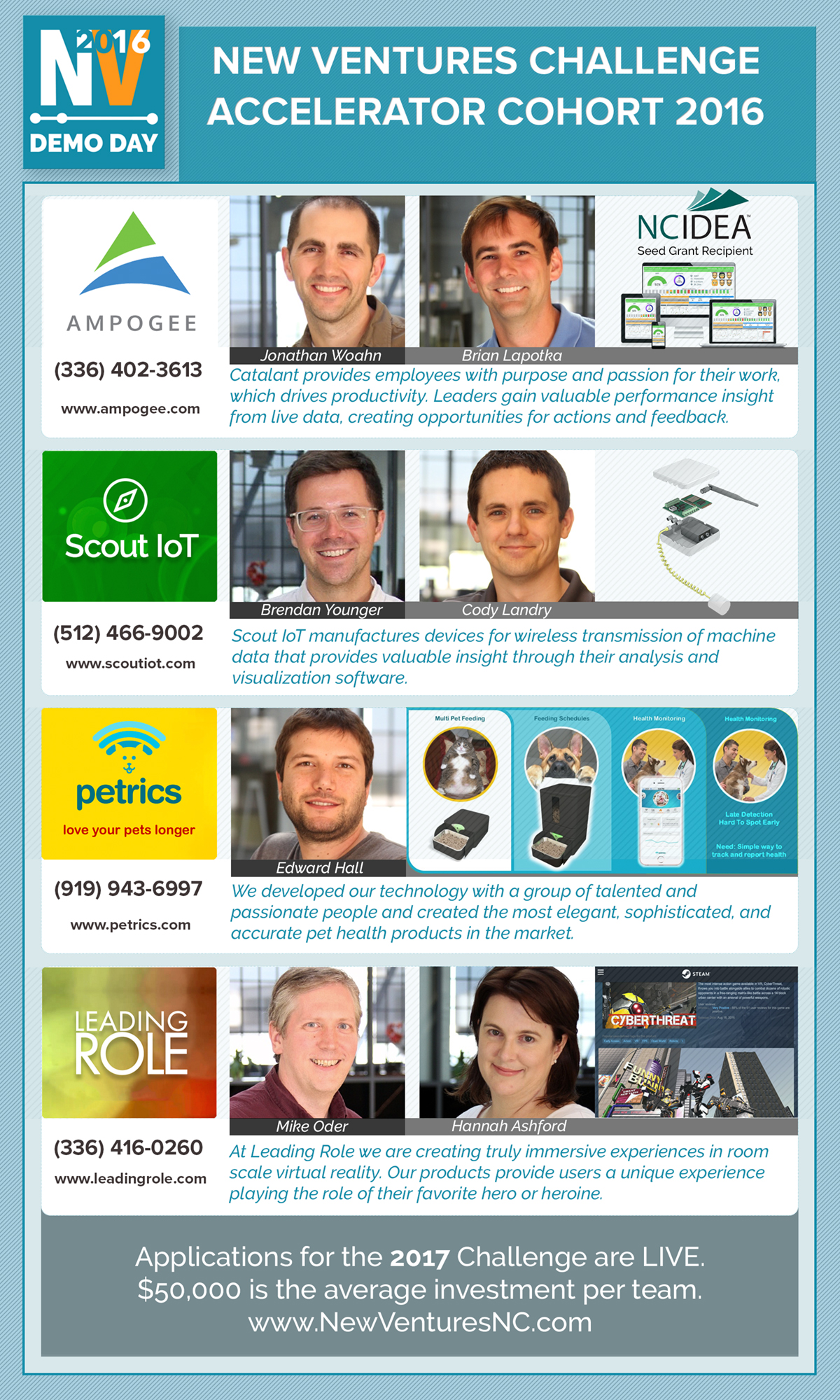

One of the 2016 cohort companies was Ampogee, who went on to win an additional grant from the NC IDEA Fund and now also has the specific interest of the local angel community. “The investment from the New Ventures club enabled us to make a key technical hire that elevated our business to the next level, said Ampogee cofounder Jonathan Woahn. “We never could have done it without them!”

“New Ventures gave us the courage to pursue Leading Role as a startup” said Hannah Ashford, cofounder of the Winston-Salem based VR content studio. “Their accelerator framework, the preparation for Demo Day, and the follow-on advisors have been invaluable.”

For the investors in New Ventures, participation is more than just the opportunity to get in early on companies that can scale. Richard Starets, a New Ventures investor and founder of Small Footprint, one of the leading software development companies in Winston-Salem explains, “The camaraderie and diversity of the investor group and quality of the entrepreneurs was impressive. While it is hard work to sort through them all, we had both quality and quantity of selection, and there are some investment-worthy entrepreneurs and great ideas right here close to home.”

The business challenge statement is broad and will consider any ideas in the categories of Business or Consumer Software Development and Applications, IT and Informatics, High Technology, and Device Innovation.

Following is a summary of last years 2016 cohort of teams.